Should You Trade $1 Options

Market Recap Webinar December 2, 2022

Mid Week Market Recap 11.30.2022

Happy Hump Day, folks!

What a wild day!

The J. Powell fireworks are always wild and today wasn’t any different.

I had mentioned watching the 20-day moving average test and that’s precisely what we got today.

Not only did we get the 20 ema test, but we also tested the bottom of the rising wedge that has been building for the last few months.

Today’s move followed the technicals to a T and was exactly what the bulls needed to hold.

Notice that the bulls are not out of the woods yet.

They still have to fight trendline resistance, once again, and the daily supply zone is just ahead.

Since Friday, I have been bullish as long as the 20-day held and today it did.

After today’s close, I would remain cautious.

On days like today, it’s best to remove bias and let the dust settle from a move like we saw.

I would expect a pullback into the ATH trendline resistance which is nearly confluent with the daily supply zone.

If we trade into 409-410 tomorrow, I would be very cautious if long.

The last time SPY traded into this level, it led to a 15% sell-off.

Obviously, today was not an FOMC presser, but I just wanted to note how the market looks after J. Powell speaks. Powell FOMC represented my purple circles or red arrows.

Notice the January, May, and June FOMC events were head fakes and led to opposite moves the following day.

I’m not going to say today was a head fake, I just want you all to be aware today’s monster move means nothing until we see confirmation.

A close above the rising wedge and the supply zone would be step one.

And we should see this test soon.

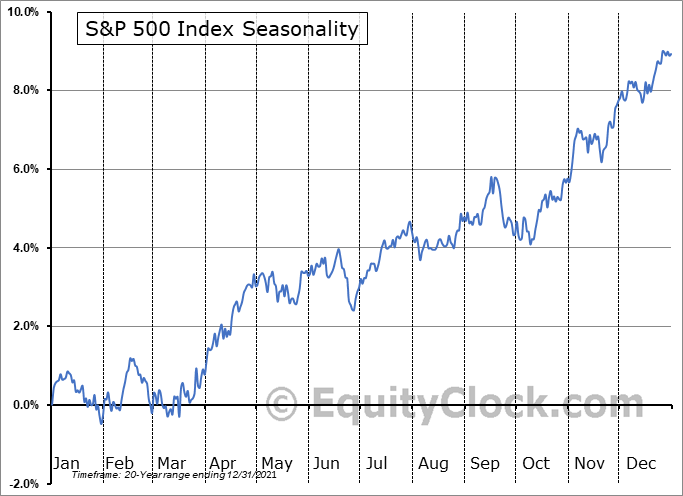

Let’s talk seasonality:

As I have been mentioning since November, we are in the most bullish time of the year.

Allowing the dust to settle and not rushing into things would be the most vigilant move to make. I recommend watching the weekly candle for additional confirmation in the markets.

I look forward to talking with you all again on Friday afternoon!

I plan on going live again on Zoom at 4 pm ET if we have interest.

I would like to make it a Q&A session or a chart request session along with general market commentary, so please email any charts or questions prior and I will be sure to answer them live during the webinar.

You can get in touch with me at [email protected]

Have a great rest of the week and be careful!

–Dylan

(Head Analyst)

11.28.2022 Market Recap

As always, if you have questions for me or about 2-Day Trader, feel free to email me at [email protected].